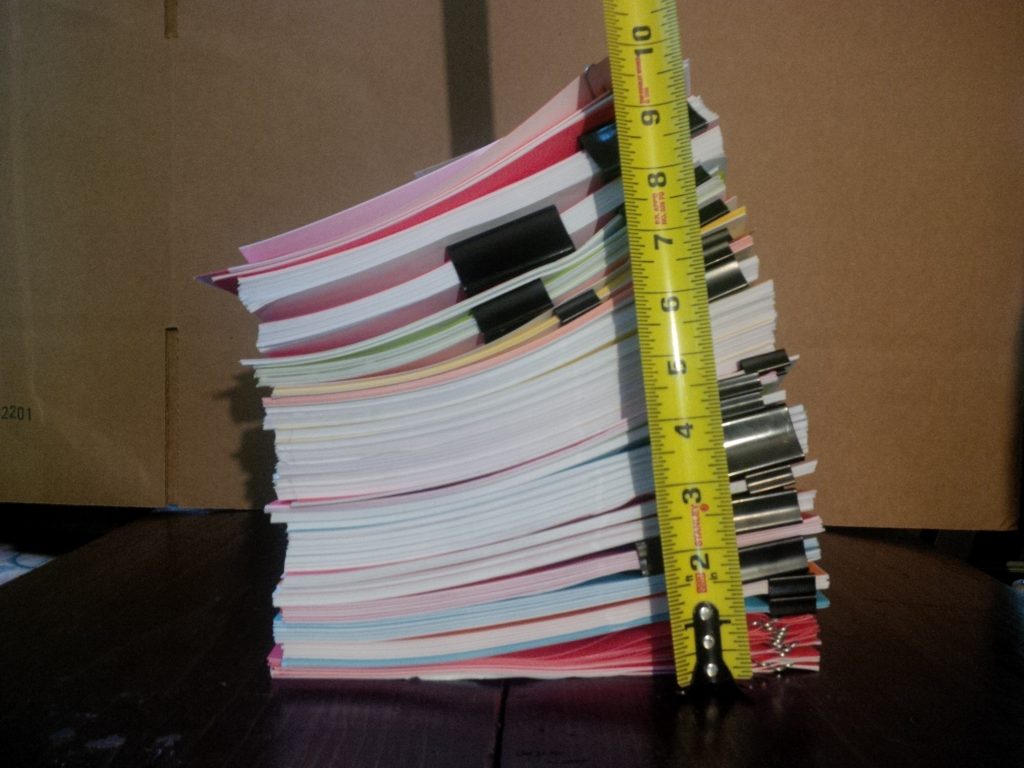

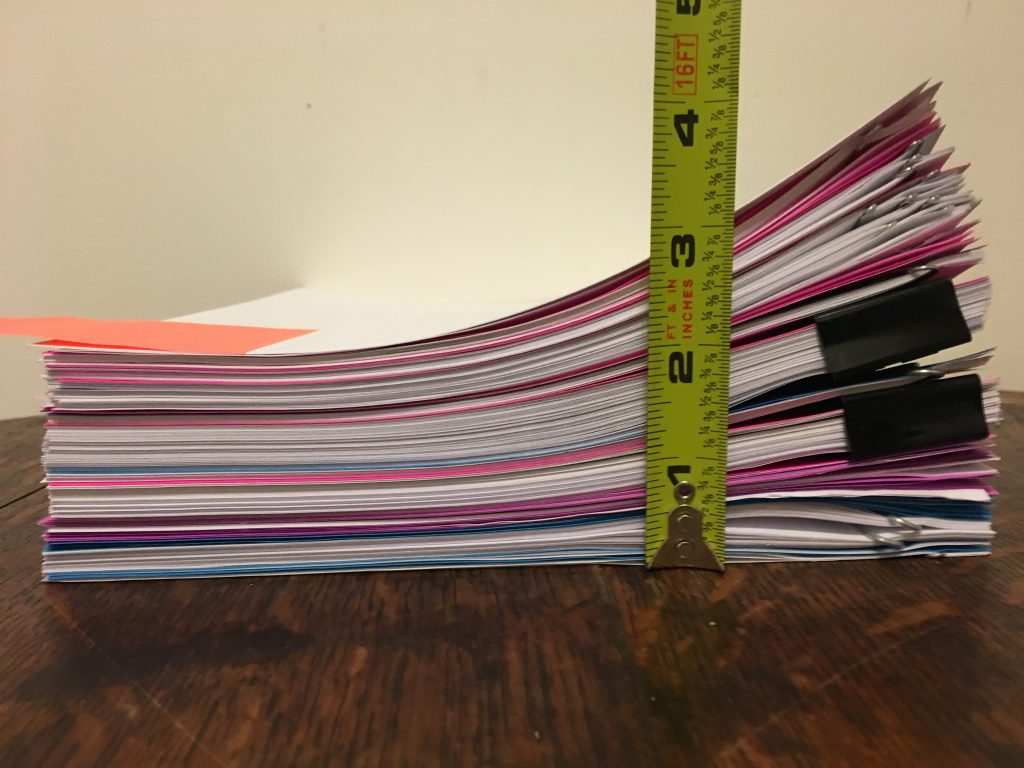

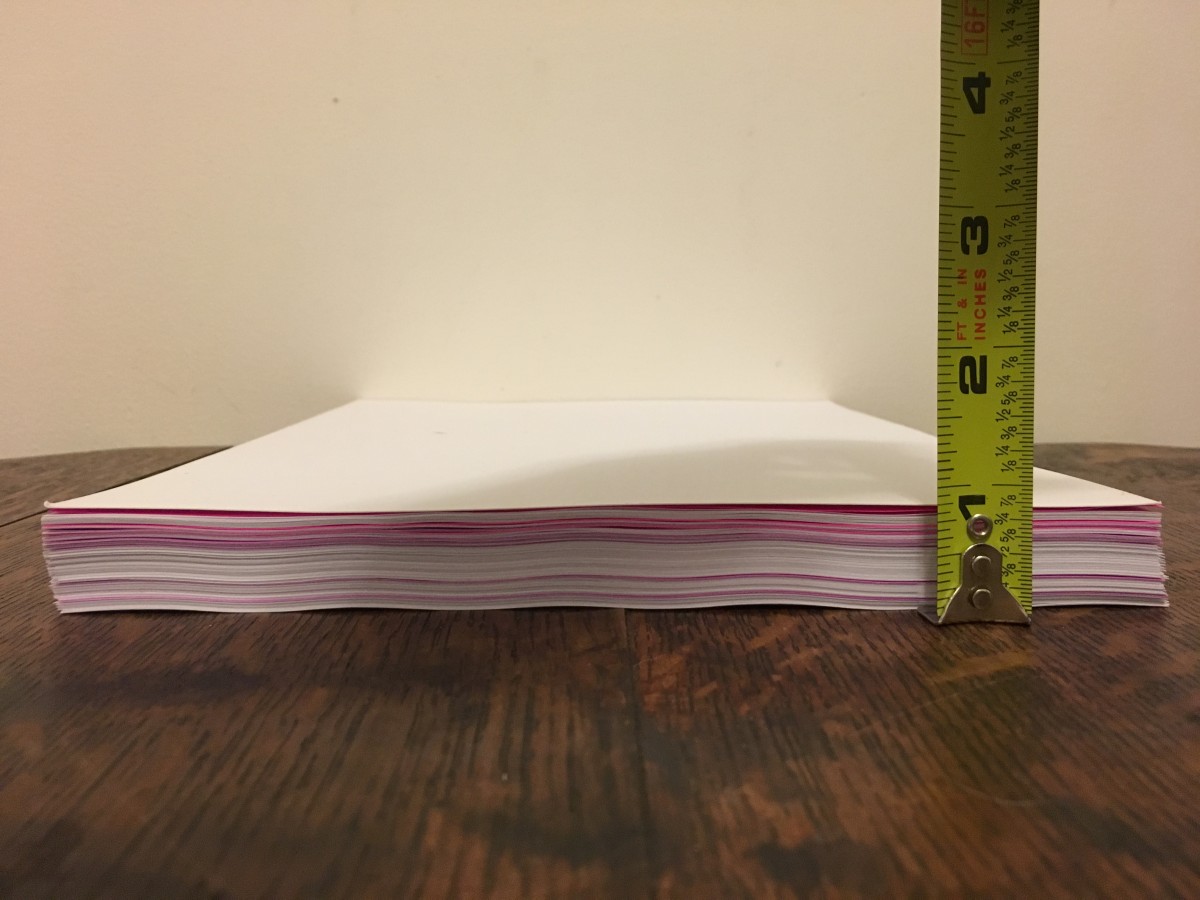

Many buyers are surprised by the sheer amount of paperwork involved in purchasing a co-op or condominium apartment in New York City.

As a real estate broker in Manhattan for over 20 years, I’ve personally completed and reviewed more than 1,000 condo and co-op purchase applications.

In contrast, purchasing an apartment in a co-op requires board approval. Applicants must submit extensive documentation to verify their financial standing, including account statements, tax returns, and more. This makes the co-op purchase application far more time-consuming, particularly for business owners.

The co-op board will review the applicant’s purchase application and conduct either an in-person or video interview. Afterward, the board will either accept or reject the applicant. Co-op rejections are typically based on financial criteria or concerns about the buyer’s ability to adhere to building rules. While the board does not have to provide a reason for rejection—and rarely does—these two factors are the only legal grounds for denial.

In contrast, for resale condos, there is no board interview. However, buyers must still submit an application, and many condo boards now require documentation similar to that of co-ops. That said, co-op boards generally have stricter financial requirements.

Another key difference is that condo boards hold a “right of first refusal,” meaning they can preempt the sale by offering to buy the apartment on the same terms. However, condo boards rarely exercise this option, as they typically lack the financial resources or motivation to do so.

Following are some other differences between co-op and condo apartments in NYC.

COST

<>Condos tend to be more expensive, often 9-40% higher than co-ops.

<>Condo buyers also face higher closing costs. While closing costs for most buyers range from 2%-3% of the purchase price, condo buyers must pay additional expenses, such as title insurance (0.5%-0.7% of the purchase price) and a mortgage recording tax. In NYC, the mortgage recording tax is 1.8% for loans under $500,000 and 1.925% for loans over $500,000.

<>With a condo, you can put down as little as 10% and finance the rest. Co-ops, however, require at least 20% down, with some buildings demanding 50% or even forbidding financing altogether.

INVENTORY

<>Co-ops dominate the NYC real estate market, comprising approximately 65% of the available apartments, while condos make up 35%. This ratio is gradually shifting as most new developments and conversions are sold as condos.

RULES & REGULATIONS

<>Co-ops generally have stricter vetting processes, which often result in greater financial security for the building.

<>Co-ops tend to have higher rates of owner occupancy compared to condos. Co-op boards frequently impose restrictions on subletting and the use of apartments as pieds-à-terre. Some co-ops prohibit rentals altogether, while others allow limited rentals, typically for one or two years, with board approval required for tenants.

<>When you purchase a co-op, you’re not technically buying real property. Instead, you own shares in the corporation that owns the building. Larger or more expensive apartments correspond to more shares. Co-op owners are legally considered tenants, which provides them with certain protections under NYC landlord-tenant laws that condo owners do not receive.

*If you are getting a mortgage, there will be paperwork required by your lending institution.

Looking to buy or sell a property in NYC? Contact Dickse Fitzgerald